As we embark on Q2 of 2024, we want to share with you some exciting new updates to MeevoPay, Meevo’s all-in-one payment processing solution. Not only are these latest enhancements real game-changers for your productivity, but they’ll also enhance your guest experience and boost profitability. And they’re all free and included with MeevoPay.

Let’s take a look!

WHAT’S NEW?

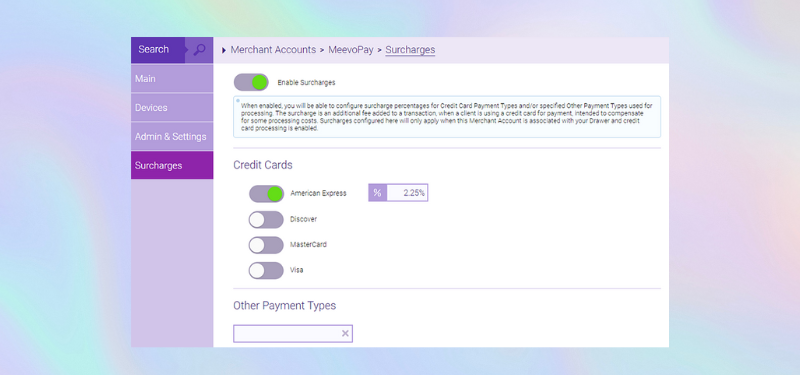

Surcharges on Credit Card Use

A surcharge, sometimes called a checkout fee or service fee, allows you to charge a small fee when customers pay using credit cards, offsetting your cost of processing credit transactions. When enabled, surcharges will be applied to transactions in the Meevo register and during self-pay, online booking, in-person, e-commerce, and eGift transactions.

Why You’ll Love It

The clearest benefit of this feature is that you’ll be able to recoup some (if not all) of your credit card transaction costs. This helps reduce business expenses, increase margins, and boost profitability.

It also creates more transparent pricing for your client base, allowing you to explicitly state the surcharge associated with credit card payments instead of hiding them in the price of goods and services. This helps build client trust and creates an opportunity to educate guests on credit card transactions. Plus, it encourages them to use lower-cost payments such as debit cards or cash.

What You Should Also Know

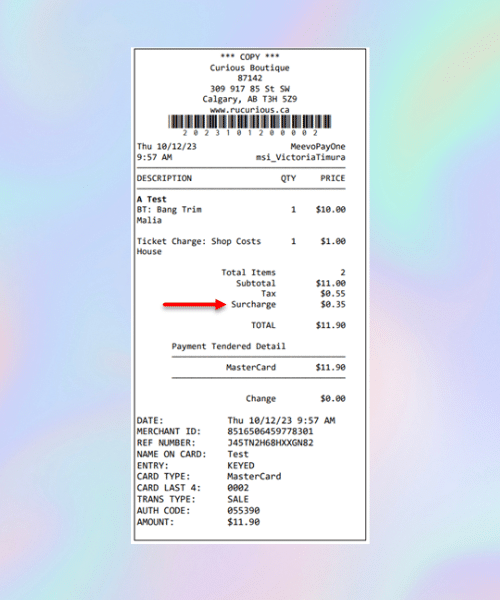

MeevoPay helps you further create transparency with guests by automatically itemizing surcharges on receipts. To maintain your clients’ trust, you’ll want to be upfront about surcharges and point out the line items on receipts.

Surcharges can be applied to American Express, Discover, MasterCard, and Visa credit card payments.

They can also be applied to alternative payment methods such as PayPal or Venmo, or custom “other payment types.” Surcharges do not get applied to debit or prepaid gift card payments.

Credit card surcharging is subject to various regulations and guidelines that vary by region and payment network. Businesses considering surcharging should carefully review these regulations and consider the potential impact on customer relationships before implementing such policies. If surcharging, you will need to disclose the percentage being charged and that the surcharge amount is not greater than the merchant’s cost of acceptance.

Real-Time Account Updater

MeevoPay’s new Real-Time Account Updater will automatically update expiration dates and other information for credit cards on file during a transaction. This means during a transaction or billing attempt using a card on file, Meevo automatically reaches out to the card issuer to see if card details have expired or been updated. If the card issuer has new info available, Meevo immediately updates the card on file details in Meevo. If successful, the transaction will go ahead and process the card.

Why You’ll Love It

This feature drastically reduces the amount of manual collections you’ll have to perform, saving you tons of time and effort. It also cuts down on credit card errors, keeps your register running smoothly and avoids any hassle for guests when they make a payment. The Real-Time Account Updater is particularly great for those of you who have cards on file for recurring billing like memberships or payment plans. It protects and drives that existing revenue by lessening the chances of a lapse in payment.

What You Should Also Know

Not all card issuers participate in credit card updates this way. Any expired credit card that is charged and can’t be automatically updated will simply result in a declined payment.

With these new MeevoPay upgrades you’ll be able to process credit card payments with more confidence and less hassle–transforming your productivity and revenue.

Ready to learn more about benefiting with MeevoPay?

If you are already a MeevoPay client or are interested in becoming one, join our upcoming webinar about how MeevoPay provides risk mitigation, fraud protection, payment processing efficiencies and total peace of mind.

We’re so excited to hear about how MeevoPay is helping your salon and spa excel in reaching your goals!